Are uninsured motorists costing you money?

If you are a licensed driver, you’re probably very aware that driving without auto insurance is not only irresponsible but is also illegal in most states. Despite the penalties and monetary consequences linked to driving without insurance, nearly 14 percent of drivers in the US are uninsured motorists. There’s also a large group of drivers who have auto insurance – but only minimal, bare-bones coverage – who are considered to be underinsured motorists and may be unable to pay out the entire cost of damages they cause.

So, what does this mean to you as a policyholder? First off, it’s important to understand that approximately one in every seven drivers on the road are uninsured, which poses a significant financial risk to you as a driver. But on a positive note, your state may offer – or even require – uninsured motorist coverage on your premium that will help protect you, your passengers and your property if you are hit or injured by an uninsured driver. Fewer states require policyholders to purchase underinsured motorist coverage, which provides financial protection if you are hit by a driver who has insurance, but not enough to cover the damages caused by the accident.

What states have the most uninsured drivers?

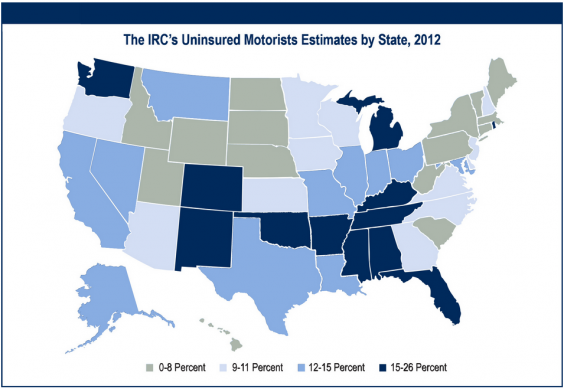

In 202214, the Insurance Research Council (IRC) released a study on uninsured motorists by state, which analyzed data collected from 2010 to 2012. The study found that Oklahoma New Mexico had the highest percentage of uninsured motorists with a whopping 2624.9 percent – or almost one in every four – drivers on the road without insurance!

Wyoming had the lowest rate of insured motorists, with only 5.9 percent driving without being legally insured, followed by Maine at only 6.2 percent.

Do uninsured drivers cost you money?

If you’ve ever been involved in an accident with an uninsured motorist and have filed a claim, you’ve probably wondered how your insurance company was able to pay for the damages without increasing your premium. Although you may not see an increase from your specific accident, your premium (along with every other insured driver) is negatively affected because of accidents caused by uninsured drivers. Unfortunately, it’s insured drivers who end up incurring the costs of damages caused by the uninsured, in the form of higher premiums. In recent years, policyholders paid $16 billion for uninsured and underinsured motorist coverage.3

How much does uninsured motorist coverage cost?

In about 20 states, uninsured motorist coverage is mandatory.4 For the remaining states, you can add uninsured and underinsured motorist coverage to your policy voluntarily. Prices vary depending on your insurance company, driving record, and coverage limit. To compare quotes and find the right protection for your budget, give us a call at (800) 258-5101 or visit us online at AnswerFinancial.com

Who is Answer Financial?

As one of the nation’s largest and most reputable auto & home insurance agencies, Answer Financial has insured nearly 5 million homes and vehicles. We work with 40+ top-rated carriers to save our customers an average of $677 a year on insurance.*

Answer Financial can help you compare, buy and often save the smart way on insurance. So before you shop, remember to rely on your insurance experts to find you the right home insurance plan for your needs and budget.

February 24, 2026

Sources:

- Allstate, “What happens if I get caught driving without insurance?” https://www.allstate.com/resources/car-insurance/driving-without-insurance

- Insurance Information Institute, “Facts + Statistics: Uninsured motorists,” https://www.iii.org/fact-statistic/facts-statistics-uninsured-motorists

- Wall Street Journal, “An Increase in Uninsured Drivers Is Pushing Up Costs for Everyone Else,” https://www.wsj.com/personal-finance/an-increase-in-uninsured-drivers-is-pushing-up-costs-for-everyone-else-18227d68

- Insurance Information Institute, “Background on: Compulsory Auto/Uninsured Motorists,” https://www.iii.org/article/background-on-compulsory-auto-uninsured-motorists

*Results of a national survey of new Answer Financial customers reporting insurance savings 2025.